Our April Origin Report looks to El Salvador following a visit to our producing partners Diego Baraona of Los Pirineos and Andres Acosta of Finca Santa Matilde, Finca Nazareth, and Finca Atzumpa. As part of our continued effort to maintain close relationships with our partners, we were glad to visit them last month to catch up, plan out the harvest, and hear their perspectives on the latest news from El Salvador's coffee industry. We're excited to share their insights along with notes from our Buying Team about their recent trip in this report, as well as looking at the latest movement in the C Market and updates from the International Coffee Organization's March 2022 report.

The World Market

C-Market Analysis

Source: Tradingview

Source: Tradingview

Since our March report, the market has shown upward movement from $2.20/lb up to $2.33/lb at the time of writing (April 13). This movement could indicate that the market's multi-month rally may not be over yet, or perhaps that the trading band of $2.20–2.60/lb is the new normal.

Following the high point of $2.60/lb reached on February 10, the market saw a steady downward trend reaching $2.10/lb at its lowest point on March 15. A reversal of this downward trend appears to have started in earnest on March 29 when, following three days of falling prices, the market closed at $2.15/lb. Prices climbed again to $2.32/lb before correcting to $2.26/lb. This pattern is important to note as it demonstrates an elevated low point ($2.15 compared to $2.10/lb) as well as an elevated high point ($2.30 compared to $2.25/lb). This trend continued on April 8, showing the previous resistance line of $2.26 as the market's current support, and a new resistance mark of $2.36/lb.

These support and resistance lines are illustrated in the candlestick chart above. In theory, higher lows and highs demonstrate confidence in the market as buyers are continuing to trade at the elevated levels.

Global Coffee Industry Statistics

Source: ICO Coffee Market Report, March 2022

Source: ICO Coffee Market Report, March 2022

- The 17 month streak of price increases on the ICO Composite Price Index was broken in March. Index prices fell 7.6% from the month prior, averaging 194.78 US cents/lb.

- In the first 5 months of coffee year 21/22 (beginning October 1, 2021), exports from South America decreased significantly compared to the previous year, down 14.5%. This was compensated somewhat by a 21.6% increase in exports from Asia & Oceania.

- Global exports reached 47.18 million bags in the first five months of coffee year 2021/22, a decrease of 3% as compared with 48.65 million bags for the same period in coffee year 2020/21.

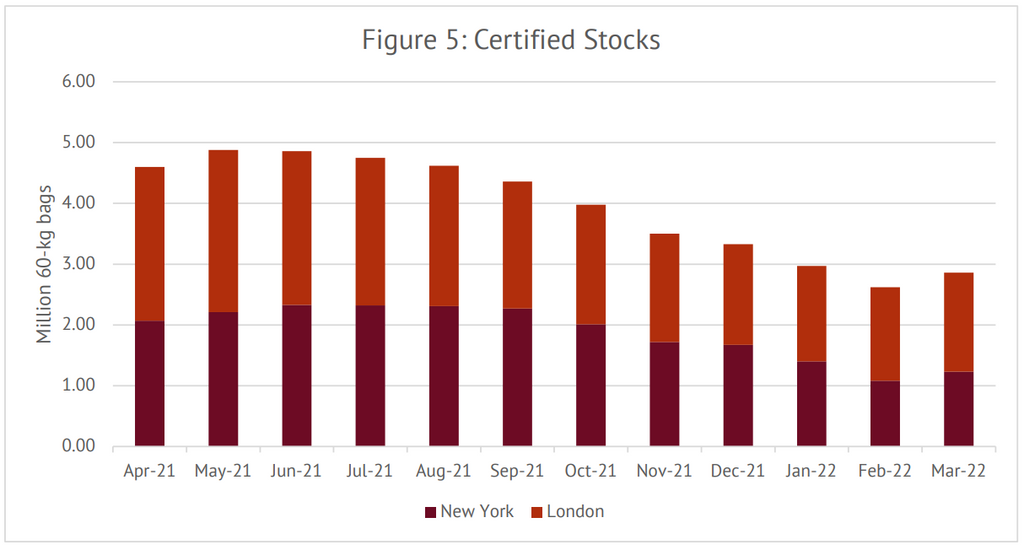

- Certified stocks of both Arabica and Robusta coffee both saw an increase in stock levels for the first time since May 2021. Specifically, Arabica increased 13.9% to 1.23 million bags.

- The latest global production forecast for coffee year 2021/22 remains unchanged at 167.2 million 60 kg bags. Arabica production is expected to decline 7.1% to 93.97 million bags, and Robusta to increase with 5.1% to 73.2 million bags. Global consumption is set to continue to increase, estimated at 170.3 million bags marking a 3.3% growth. This means that the gap between production and consumption is estimated at 3.1 million bags.

This section was sourced from the ICO unless otherwise indicated. Read the ICO’s full March 2022 report here.

At Origin

Harvest in Numbers and Statistics

Information in this section was sourced from Consejo Salvadoreño de Cafe as of 28 February

The expected harvest for coffee year 2021/22 in El Salvador is 559,131 bags, which would be an increase of 21% over the previous year. This is an interesting number as most Central American countries are experiencing a decrease in their harvest this season. Regardless of this notable increase for El Salvador, harvest figures are still very low compared to some historic numbers, such as the 1,751,380 bags produced in 2010, or harvests in the 1990s topping 3 million bags.

The reported average price for El Salvadoran coffee this year is $2.33/lb FOB as of February 28th; given the average C Market price during this period of the crop year (October 1–February 28), this puts the average differential at +23. These numbers represent one of the highest prices historically for El Salvadoran coffee, but one of the lowest differentials in recent years. See these numbers represented in the figure below.

Last year's crop in El Salvador was valued at $108 million, of which an astounding 83.4% was derived from "differentiated" coffees. In this case, "differentiated" refers to specialty coffees, with the remaining 16.6% derived from other grades of coffee like commodity. This number is a strong indication of producers in El Salvador's focus on quality, in part due to the reduced production volumes experienced throughout the country.

Financial values for this year’s harvest are not yet complete, but there has already been a 36.3% increase in the value of commercial coffee sold, largely due to the higher price in the C Market. Commodity coffee makes up a large portion of the volume sold so far, with many specialty contracts still being negotiated. These numbers appear to be a prelude to a sharp rise in captured value for the country's coffee industry, which could help many to recuperate following the smaller volumes produced in recent years.

Diego Baraona at the drying area of Los Pirineos in Usulután, El Salvador

Diego Baraona at the drying area of Los Pirineos in Usulután, El Salvador

Field Report: Apaneca-Ilamatepec & Usulután

In March, Specialty Coffee Sourcing Manager Bram De Hoog and Central America Green Coffee Buyer Abraham Castro visited El Salvador to taste this year's crop and continue to build our relationships with some of our producing partners in the country. Despite its small size, El Salvador was once one of the largest producers of coffee in the world; however, the country has experienced turbulent times since then, and production volumes have unfortunately declined. Andres Acosta (of Finca Santa Matilde, Finca Nazareth, and Finca Atzumpa) and Diego Baraona (of Los Pirineos) both come from multi-generation coffee farming families and know these stories well. Nowadays, both are working to lead the way in coffee production in El Salvador on the lands they inherited from their families.

El Salvador's once booming coffee industry now suffers from diminished harvest volumes, rising production costs, and competition from other industries for labor. However, coffee's legacy in the country is strong and will not be let go easily as young producers like Andres and Diego continue to innovate and move Salvadoran coffee forward. Andres shared these notes about this year’s harvest on his farms, speaking to both the challenges being faced by he and his team and the steps they’re taking to manage the difficulties:

The harvest at our farms went well in quality this year. We had a good rainy season compared to last year in all of our farms, that helped the coffee beans to ripen at the optimum time and develop consistency at the cup since there wasn’t any storm late in the year that could’ve messed up the coffee beans.

The quantity was not as much this year but we have developed good quality which is what we’re aiming for through the years since we got into specialty coffee.

We had a rough time in adapting to our new costs of production because hand labour increased by 30% in El Salvador and we pay more than the basic salary to our people because we want to make an effort to be socially responsible with our coffee family inside our farms so they can help us out as well by doing the good work that helps us get to the vision of having responsible and great quality farms.

We’ve also felt the 100% price increase in fertilizers and fungus control chemicals in the country, but we are also continuing to adopt new ways to manage eco-friendly practices within our farms such as re-using the coffee pulp, digging water and organic matter captivity holes, not using herbicides such as glyphosate that damages our employees and coffee trees as well.

We started a new process of returning minerals to our soil with waste (from restaurants such as ashes and hydrated lime from an oxygen producing factory) and by doing so we give so many minerals back and we activate the root system in the plants which allows them to eat more organic matter and fertilizer that we provide.

We are working on creating micro-climates in our farms by planting more shade trees and working with a new system that provides a less direct sunlight hit to the plants than usual, because we see that is important that the plant doesn't feel the 2 degree increase in temperature due to climate change. We need to protect our farm by doing it, so we have to risk the quantity we can produce by not letting more sunlight hit our plants and losing our crop due to the temperature increase or continue to develop the micro-climate protecting our crop, plants and quality.

So we are focusing on creating quality and maintaining it in all of our farms by using this.

(edited)

Andres Acosta with ripe cherries on a coffee tree in Concepción de Ataco, Ahuachapan, El Salvador.

Andres Acosta with ripe cherries on a coffee tree in Concepción de Ataco, Ahuachapan, El Salvador.

On our recent visit we were thrilled to further solidify our partnerships with Andres and Diego and determine new goals based on the excellent performance of their coffee over the last year and the trust we have in these farmers for their consistent quality and dedication to their farms and the Salvadoran coffee industry.

Below are some of the comments from our Central America Green Coffee Buyer Abraham Castro during his first visit to El Salvador:

My first trip to origin with Ally was to El Salvador. I sincerely traveled with great enthusiasm since in all these trips they leave nothing but teachings and new friends.

It was a very interesting trip. Seeing how the children of farmers are taking the initiative to change the vision of the industry in El Salvador, this gives us hope that the new generations still have much to offer from the origin. I would like to mention Andres Acosta from Santa Matilde and Atzumpa and Diego Baraona from Los Pirineos and congratulate them for the great work they do with the farms and the coffee process.

El Salvador is a country that can offer us from different varieties of coffees [and] processes, one of the points that I rescue is that its [offerings are] quite extensive despite the fact that over the years it has come to less in its general production.

If there is any doubt, it is a very interesting country to have within our options and I cannot leave aside the incredible views of its volcanoes and mountains.

(edited)

Future Outlook for Ally Coffee in El Salvador

This year, we're thrilled to be shipping coffees from El Salvador to more warehouses than ever before with lots slated to land at CTI-NJ, CTI-SC, the Annex, Schwarze-Hamburg, and Vollers UK. We're proud to continue working with all of our partners throughout El Salvador, finding ways to continue to grow our relationships built on consistency and loyalty, and being a part of their work to move Salvadoran coffee forward. Check in with your account manager to learn more about the lots that are coming to your region!